Some Ideas on Refinance Broker Melbourne You Should Know

You don't need to take the home mortgage trip on your very own when a home mortgage broker might have the ability to lend an aiding hand as well as obtain you the best bargain on the market Home loan brokers can take several of the tension far from the procedure of discovering the excellent mortgage for your requirements - https://about.me/unicornserve.

A home mortgage broker functions as a liaison for loan providers and also customers as well as the ideal one has the tools and links to help you locate options for your residence loan demands. Mortgage brokers have accessibility to a series of products via the panel lending institutions they are certified with. Brokers have a lawful "accountable lending" commitment to guarantee borrowers are not provided a loan that does not fit their demands, as specified in the governing guide from the Australian Securities as well as Investments Payment (ASIC) on finest interests responsibility.

A set price loan indicates you will certainly have the same rate of interest price for a duration, usually up to five years. It might make preparing your monthly finance a whole lot simpler as you will have the exact same month-to-month repayment amount throughout the repaired price term. On the various other hand, in a variable price financing, your interest rate as well as regular monthly payments may differ, relying on the current rate of interest in the marketplace.

Nonetheless, there is also a danger that you need to pay a larger settlement must the rates of interest increase. Recognizing just how much you can afford for settlement is among the initial points you need to think about when applying for a lending, full quit. You may risk back-pedaling your home mortgage if you dive in headfirst into the residential or commercial property market without recognizing your economic capabilities and also limitations.

The 9-Second Trick For Melbourne Broker

If you prepare to place much less than a 20% deposit of the total acquisition price of your potential home, you may have to spend for Lenders Mortgage Insurance (LMI). It may require time to discover the ideal mortgage broker as choosing the incorrect one can be expensive, as well as you might wind up with a home mortgage that does not truly fit your requirements or your financial circumstance.

Inspect if the broker has a variety of reliable institutions. Otherwise, you might lose out on far better home loan deals. See to it the broker can clarify the number of loan providers they have on their panel, the number of loan providers they make use of, as well as why. As a customer, you require to be sure that the product a broker is using matches your requirements.

Make sure to ask the broker to discuss all the documents related to your lending application as well as contract. You may ask for a lending product factsheet and have in writing what the broker supplies.

Refinance Melbourne Fundamentals Explained

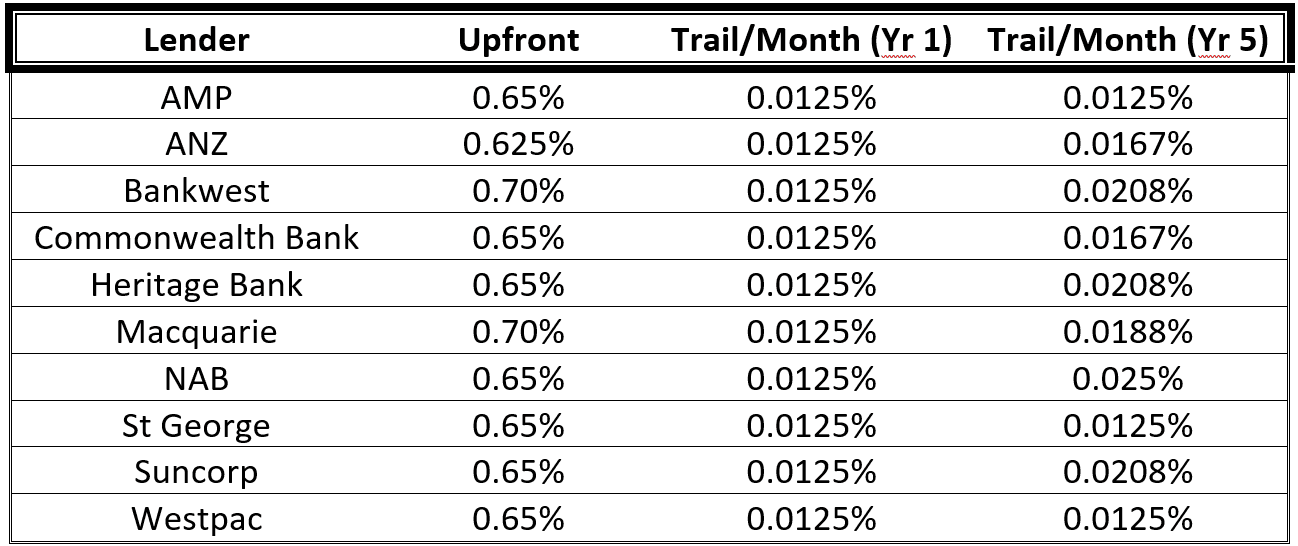

Commission prices are fairly comparable throughout lenders, with in advance compensations commonly varying from 0. 65% of the financing amount, regarding $3,000 on a $500,000 lending. 35% of the recurring loan, regarding $1,000 per year on a $500,000 financing.

You might ask the broker what compensations or benefits they obtain. Under the regulations, brokers have to divulge the commission paid to them by loan providers, so make sure that they give you this info. Maintain in mind that if a broker protects you a home loan that fits all requirements established out in the anonymous contract you have and you choose not to accept it, you might need to pay the broker's cost regardless (melbourne broker).

Mortgage brokers work with compensation, which implies they receive a portion from the lender after putting your car loan. Essentially, this indicates they offer their services to customers for free (http://unicorn-financial-service86307.ampblogs.com/Unicorn-Finance-Services-for-Beginners-49670898). This is changing as more brokers are modifying their solution suggestion as well as charging a fee for that solution.

What Does Broker Melbourne Do?

A mortgage is a long-lasting dedication. mortgage brokers melbourne. A great broker will identify that your needs and objectives will change gradually and undertaking to assist you along the road. Obtaining a home loan broker is not, by any type of ways, a requirement but it is necessary that you take into consideration getting to out to one if you are an initial house buyer.

They have all the devices and networks to find the most effective options for you based on your economic health. They are car loan specialists and are much more likely to discover the most effective deals as well as therefore save you money. They have normal call with a selection of lenders, a few of whom you might not have even learnt about.

There are some brokers who might not function with lenders who do not pay payments. There are additionally those who may recommend particular loans from a specific lender because they get a greater compensation from them. You should also see to it you do not engage with several mortgage brokers.

Prevent angling explorations as it might bring about you not having the ability to obtain the best deal (mortgage broker in melbourne). To locate a home mortgage broker near your place, go here: .

Comments on “The Main Principles Of Mortgage Broker In Melbourne”